Multiple Choice

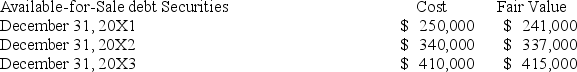

Carpark Services began operations in 20X1 and maintains long-term investments in available-for-sale debt securities.The year-end cost and fair values for its portfolio of these investments follow.The year-end adjusting entry to record the unrealized gain/loss at December 31,20X2 is:

A) Debit Unrealized Gain - Equity $3,000; Credit Fair Value Adjustment - Available-for-Sale (LT) $3,000.

B) Debit Fair Value Adjustment - Available-for-Sale (LT) $6,000; Credit Unrealized Loss - Equity $6,000.

C) Debit Fair Value Adjustment - Available-for-Sale (LT) $3,000; Credit Unrealized Gain - Equity,$3,000.

D) Debit Fair Value Adjustment - Available-for-Sale (LT) $3,000; Credit Unrealized Loss - Equity $3,000.

E) Debit Fair Value Adjustment - Available-for-Sale (LT) $6,000; Credit Unrealized Gain - Equity $6,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q34: A company had net income of $2,660,000,

Q115: Held-to-maturity securities are:<br>A)Always classified as Short-Term Investments.<br>B)Always

Q126: _ are debt securities that a company

Q133: Hamasaki Company owns 30% of CDW Corp.stock.Hamasaki

Q147: A company reported net income for Year

Q151: Investments in equity securities where the investor

Q158: A company had net income of $45,000,

Q179: Canberry Corporation had net income of $80,000,beginning

Q190: What are the accounting basics for debt

Q197: Short-term investments in held-to-maturity debt securities are