Essay

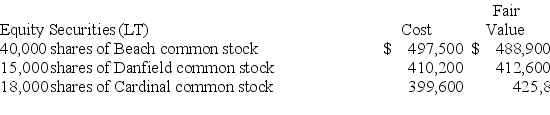

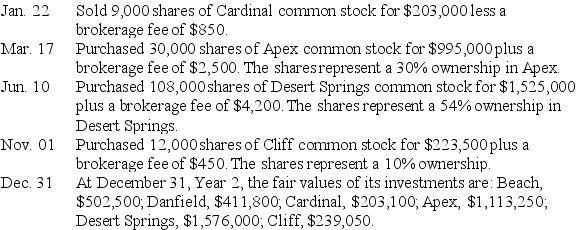

Weston Company had the following long-term equity securities in its portfolio at December 31,Year 1.Weston had several long-term investment transactions during the next year.After analyzing the effects of each transaction,(1)determine the amount Weston should report on its December 31,Year 1 balance sheet for its long-term investments in available-for-sale securities,(2)determine the amount Weston should report on its December 31,Year 2 balance sheet for its long-term investments in equity securities,(3)prepare the necessary adjusting entry to record the fair value adjustment at December 31,Year 2.

Correct Answer:

Verified

Year 1: $1,327,300 − $1,307,300 = $20...

Year 1: $1,327,300 − $1,307,300 = $20...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Profit margin reflects the percent of net

Q84: Dividends received from stock investments with insignificant

Q85: MotorCity,Inc.purchased 40,000 shares of Shaw common stock

Q88: When the cost of a long-term held-to-maturity

Q90: Long-term investments cannot include:<br>A)Held-to-maturity debt securities.<br>B)Securities with

Q91: On July 31,Potter Co.purchased GigaTech bonds for

Q101: A company has net income of $250,000,

Q178: On January 4,Year 1,Barber Company purchased 5,000

Q188: Long-term investments in held-to-maturity debt securities are

Q191: _ financial statements show the financial position,