Essay

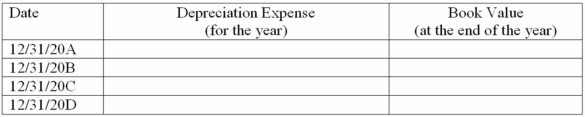

On January 1, 20A, Stern Company (a calendar year corporation) purchased a heavy duty machine having an invoice price of $13,000 plus transportation and installation costs of $3,000. The machine is estimated to have a 4-year useful life and a $1,000 residual value. Assuming the company uses the declining-balance method depreciation and a 150% acceleration rate, complete the following schedule (round to the nearest dollar).

Correct Answer:

Verified

* straight line rate: 1/4 = 0.25

* straight line rate: 1/4 = 0.25

Declin...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Declin...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Kovacic Company purchased a computer that cost

Q2: Recording depreciation expense does which of the

Q3: Intangible assets<br>A) should be reported as Current

Q4: The amortization of finite life intangibles is

Q6: On September 7, 20B, Belverd Corporation purchased

Q7: When an entire business is purchased, goodwill

Q8: An asset being amortized with the straight-line

Q9: Chamber Company purchased a truck on January

Q11: Depreciation expense and impairment losses are presented

Q11: The apportionment of the acquisition cost of