Essay

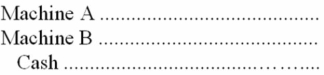

Raco Inc. purchased two used machines together to get a lower total cash price of $90,000. The machines were different, although of the same general type. They were designated as Machines A and B. New machines of the same type could be purchased as follows: Machine A, $25,000; Machine B, $75,000. Complete the following entry to record the purchase and show your computations.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Lawson Pet Shop Limited bought new grooming

Q24: Acquiring and disposing of long-lived assets are

Q27: Which of the following statements is false?<br>A)

Q29: FAL Corporation purchased a robot to be

Q30: A company that is self-constructing a new

Q31: Weaver Mining Company purchased a site containing

Q32: In accounting for tangible operational assets, the

Q33: Angstrom Corporation purchased a truck at a

Q130: A change in the estimated residual value

Q183: Building and equipment are recorded at their