Essay

Tweed Feed & Seed purchased a new machine on January 1, 20A:

Accumulated depreciation at the end of year 5 (assume straight-line depreciation) $12,000

Accumulated depreciation at the end of year 5 (assume straight-line depreciation) $12,000

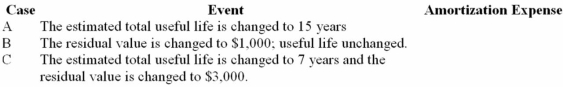

It is now the beginning of year 6 and the management re-evaluated the estimates related to the machine. Compute the depreciation expense for year 6 under each of the following independent cases:

Correct Answer:

Verified

CASE A: (26,000 - 12,000 - 2,000) ÷ (15 ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: When an operational asset is acquired for

Q62: Expenditures made after the asset is in

Q86: If a second-hand machine is purchased for

Q136: Airbury Company acquired manufacturing equipment at an

Q137: When an asset is retired, the amount

Q139: On March 1, 20A, Jance Company purchased

Q140: Macon Assembly Company purchased a machine on

Q141: A company purchased equipment for $800,000 and

Q142: All of the following are examples of

Q157: When using the declining-balance method of depreciation,