Essay

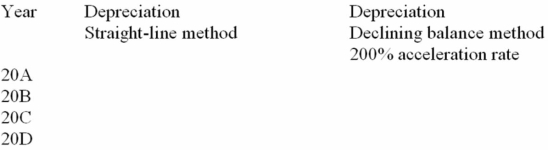

Hilman Company purchased a truck on January 1, 20A, at a cost of $34,000. The company estimated

that the truck would have a useful life of 4 years and a residual value of $4,000. Required:

1. Complete the following table:

2. Which of the two methods in part 1 would result in:

2. Which of the two methods in part 1 would result in:

a. Lower profit in 20A?

b. Lower profit in 20D? ________

Correct Answer:

Verified

Declining-balance:

20A 1/4 × 200% × $34,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

20A 1/4 × 200% × $34,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: If a trademark is developed internally, it

Q62: Expenditures made after the asset is in

Q114: A tangible asset must be fully depreciated

Q123: How is the matching principle related to

Q124: Duval Company acquired a machine on January

Q126: The following information is available for C

Q127: Which of the following is not a

Q131: On April 1, 2014, Michal Company sold

Q132: A machine that cost $72,000 has an

Q197: When a change in estimate is made,