Essay

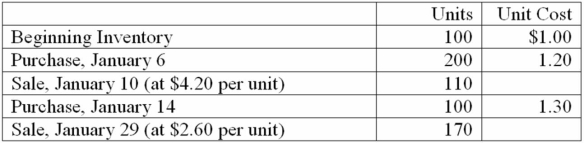

Davis Company uses the perpetual inventory system and the FIFO inventory costing method. All purchases and sales were cash transactions. The records reflected the following for January, 20B

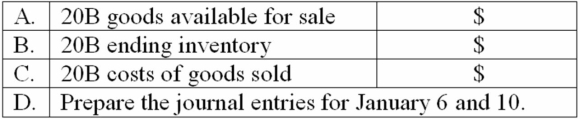

Determine the following

Determine the following

Correct Answer:

Verified

A. $100 + 240 + 130 = $470 (4...

A. $100 + 240 + 130 = $470 (4...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q47: The FIFO inventory cost formula agrees closely

Q98: An error that overstates the ending inventory

Q116: A low inventory turnover ratio indicates that

Q129: The consistent application of an inventory cost

Q130: The 20B records of Tom Company showed

Q131: Under the lower of cost and net

Q132: Wibber Company prepared income statements that reflected

Q134: Inventory that originally cost $10,000 was written

Q135: An error in the measurement of ending

Q137: If net realizable value of the inventory