Short Answer

Landings Inc. provided the following footnote in their annual report:

Inventories are stated at the lower of cost or net realizable value. The cost of inventories has been determined using last in first out (FIFO) method. Cost of goods sold under FIFO costing were $22.2 billion for 20B and ending inventory under FIFO was $1.3 billion. Inventory in 20A under FIFO costing was $1.2 billion.

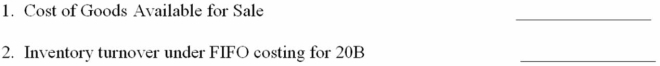

Compute the following for Landings:

Correct Answer:

Verified

1) 22.2 + 1.3 = 23.5...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: House Depot Company hired a new store

Q65: Richardson Ltd. sells many products. Hela is

Q66: Match the inventory system with the statement

Q67: Assume World Company buys compact disks at

Q70: An increase in inventory turnover means, days

Q71: Compute the missing amounts for the income

Q72: The records of Tea Time Company show

Q73: Which of the following is true?<br>A) Factory

Q74: Joe Company sold merchandise with an invoice

Q124: The cost of goods purchased for resale