Multiple Choice

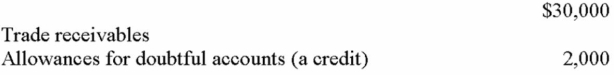

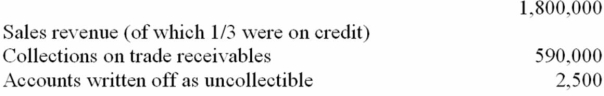

The books of Tweed Company provided the following information: Beginning balances:  Transactions during the year:

Transactions during the year: Past collection experience has indicated that 1% of credit sales normally is not collected. Therefore, an adjusting entry for bad debt expense should be made in the amount of whic of the following?

Past collection experience has indicated that 1% of credit sales normally is not collected. Therefore, an adjusting entry for bad debt expense should be made in the amount of whic of the following?

A) $6,500.

B) $500.

C) $2,500.

D) $6,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: In recording the year-end adjusting entry for

Q3: On June 1, 20B, Budget Appliance Company

Q4: When is revenue recognized under the percentage

Q6: On a bank reconciliation, which of the

Q8: A high receivables turnover ratio indicates<br>A) customers

Q9: If a company has the opportunity to

Q10: Which of the following is required for

Q11: Following the completion of an aging analysis,

Q12: The balance in Allowance for Doubtful Accounts

Q139: For service companies, revenue is recognized the