Essay

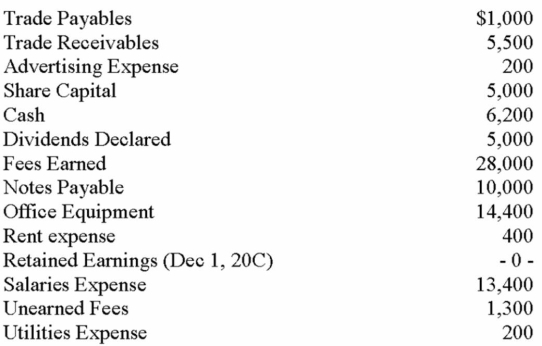

The following alphabetical listing shows all of the account balances taken from the unadjusted trial balance at December 31, 20C, the end of the first month in business for Virginia Graphics Corporation:

Virginia Graphics Corporation Unadjusted Trial Balance December 31, 20C  The note payable above was for $10,000 borrowed on December 1, 20C at the start of the business. The note and interest at 12% are to be repaid on June 30, 19E. The office equipment was acquired on December 1, 20C. It has an estimated life of 4 years with no salvage value. The company uses straight-line depreciation. The Unearned Fees resulted from $1,300 collected in advance from a new customer, Richmond Company, on December 10, 20C. By December 31, 20C, services amounting to

The note payable above was for $10,000 borrowed on December 1, 20C at the start of the business. The note and interest at 12% are to be repaid on June 30, 19E. The office equipment was acquired on December 1, 20C. It has an estimated life of 4 years with no salvage value. The company uses straight-line depreciation. The Unearned Fees resulted from $1,300 collected in advance from a new customer, Richmond Company, on December 10, 20C. By December 31, 20C, services amounting to

$1,000 had been provided to Richmond Company. The company expects to pay income taxes of 10% on pretax profit.

Virginia Graphics needs help in preparing its financial statements for its first month in business. Sinc you are taking an accounting course, your neighbour, the owner of Virginia Graphics, has asked you to help.

Required:

1. Prepare the necessary adjusting journal entries based on the information provided above. (You nee not include explanations).

2. Prepare an income statement.

3. Explain the effect on the income statement if the adjustment for interest expense had not been made.

Correct Answer:

Verified

3. Interest expense (and tot...

3. Interest expense (and tot...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Earnings per share is calculated by dividing<br>A)

Q63: In the indirect method, the operating activities

Q64: If accounting information has confirmatory value, it<br>A)

Q65: The two qualitative characteristics that are defined

Q66: Which of the following would appear in

Q69: "Toys 4 U" is a retail toy

Q70: What amount of current assets would appear

Q71: The users of accounting information are decision

Q72: Liabilities are generally classified on a statement

Q110: Materiality and relevance are both defined in