Essay

Below are four transactions that were completed during 20A by Doby Company. The annual accounting period ends on December 31. Each transaction will require an adjusting entry at Decembe 31, 20A. You are to provide the 20A adjusting entries required for Doby Company.

A. On July 1, 20A, Doby Company paid a two-year insurance premium for a policy on its equipment This transaction was recorded as follows:

July 1, 20A:

December 31, 20A--Adjusting entry:

December 31, 20A--Adjusting entry:

B. On December 31, 20A a tenant renting some office space from Doby Company had not paid the rent of $500 for December.

December 31, 20A--Adjusting entry:

C. On September 1, 20A, Doby Company borrowed $3,000 cash and gave a one-year, 10 percent, note payable. The total interest of $300 is payable on the due date, August 31, 20B. The note was recorded as follows:

September 1, 20A: Cash $3,000

Note payable $3,000

December 31, 20A--Adjusting entry:

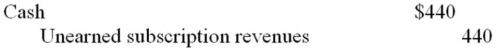

D. Assume Doby Company publishes a magazine. On October 1, 20A, the company collected $440 for subscriptions two years in advance. The $440 collection was recorded as follows:

October 1, 20A:

December 31, 20A--Adjusting entry:

December 31, 20A--Adjusting entry:

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Closing entries<br>A) cause the revenue and expense

Q6: An adjusted trial balance is usually developed

Q7: Each adjusting entry affects at least one

Q8: Ten independent transactions for Scooter Corporation are

Q9: All of the accounts in an accounting

Q10: Temporary accounts are closed to a zero

Q11: An accountant has billed her clients for

Q45: The Income Summary account is a permanent

Q53: Expenses paid before being used or consumed

Q76: Financial statements are generally prepared before the