Essay

Four transactions are given below that were completed during 20A by Wren Company. The annual accounting period ends December 31. Each transaction requires an adjusting entry at December 31, 20A. You are to provide the adjusting entries required for Wren Company.

A. On December 31, 20A, Wren Company owed employees $1,750 for wages that were earned by them during December and were not recorded.

December 31, 20A--Adjusting entry:

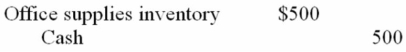

B. During 20A, Wren Company purchased office supplies that cost $500 which were placed in the supplies room for use as needed. The purchase was recorded as follows:

20A:

At the beginning of 20A, the inventory of unused office supplies was $75. At the end of 20A, a coun showed unused office supplies in the supply room amounting to $100.

At the beginning of 20A, the inventory of unused office supplies was $75. At the end of 20A, a coun showed unused office supplies in the supply room amounting to $100.

December 31, 20A--Adjusting entry:

C. On December 1, 20A, Wren Company rented some office space to another party. Wren collected

$900 rent for the period December 1, 20A, to March 1, 20B. The rent collected was recorded as

follows:

December 1, 20A:

December 31, 20A--Adjusting entry:

December 31, 20A--Adjusting entry:

D. On June 1, 20A, Wren Company borrowed $2,000 cash on a one-year, 10% interest-bearing, note payable. The interest is payable on the due date, May 31, 20B. The note was recorded as follows:

June 1, 20A:

Correct Answer:

Verified

December 3...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q58: Expenses paid in advance of the use

Q103: Adjusting entries are used to update income

Q104: Which of the following statements is true

Q105: At the end of 20D, the following

Q107: Which of the following is true about

Q109: The return on equity measures how well

Q110: On September 1, 20A, RF Corporation collected

Q111: Which of the following statements about a

Q112: Earnings per share is widely used in

Q113: A list of the accounts of TIP