Essay

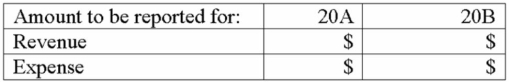

Small Company rendered services to customers amounting to $6,000 during 20A; the related cash was collected as follows: $4,000 in 20A; $2,000 in 20B. During 20A, $3,000 was incurred for wages expense; the related cash payments were made as follows: $1,200 in 20A; in 20B, $1,800. Based onl on these data, provide the following amounts:

Correct Answer:

Verified

Correct Answer:

Verified

Q10: An accountant has debited an asset account

Q11: Recording revenue<br>A) has no effect on total

Q13: Under the accrual basis of accounting<br>A) cash

Q15: Which of the following is not an

Q19: The revenue principle recognizes revenues when the

Q66: A credit means that an account has

Q68: Accrual basis accounting records revenues when earned

Q88: Revenue accounts normally have debit balances because

Q98: A Taco Bell restaurant would most likely

Q108: A decrease in a liability account is