Essay

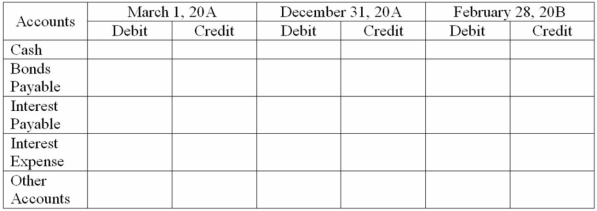

On March 1, 20A, Warner Corporation, a calendar year company, issued 40 of its $1,000, 8%,

five-year bonds at par. The bonds were dated March 1, 20A, and the first interest payment will be on February 28, 20B. The accounting period ends December 31.

Part A: Complete the journal entry grid for each of the following dates (round to the nearest dollar)

Part B: Discuss why an entry is needed on December 31, 20A

Part B: Discuss why an entry is needed on December 31, 20A

Correct Answer:

Verified

Computations:

Computations:

(a) Sold at par, $40,000

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(a) Sold at par, $40,000

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: In 2014, H Co's times interest earned

Q22: In 2014, C Co. reported a times

Q23: When a bond investment is sold (issued)

Q24: The times interest earned ratio uses accrual

Q25: Which of the following statements is true?<br>A)

Q28: The amortization of a bond discount results

Q29: Webber Company reported the following information for

Q54: Bonds are debt instruments issued by corporations

Q59: The effective (market) interest rate almost always

Q125: A note payable must always be paid