Essay

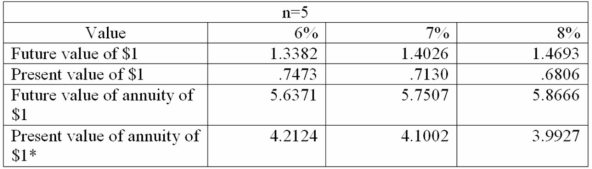

The following table values are provided for use in solving the following independent problems (show computations):

*Ordinary annuity

*Ordinary annuity

A. Company A deposited $20,000 in a savings account on January 1, 19A that will accumulate 6% interest each December 21.

1. What will be the fund balance at the end of Year 5

2. How much interest will be earned by the end of Year 5?

B. Company B needs to accumulate a $50,000 fund by making five equal annual deposits. Assuming a 7% interest accumulation, how much must be deposited at the end of the year?

C. Company C has new machine that has an estimated life of five years and a $5,000 residual value. Assuming an 8% interest rate, what is the present value of the estimated residual value?

D. Company D owes a $50,000 debt that is now due (January 1, 19A). Arrangements have been made to pay it off in five equal annual installments, starting December 31, 19A (an ordinary annuity situation).

1. Assuming 8% interest, how much will the annual payment be?

2. Give the entry for Company D above for the first payment on December 31, 19A on the note payable.

Correct Answer:

Verified

A. 1. $20,000 × 2.3382 (Fn = 5:1; I = 6%...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: Bonds often are a superior method of

Q49: On January 1, 20A, Washer Company sold

Q51: If the market interest rate is higher

Q52: On January 1, 20A, Winston Corporation sold

Q54: Accrued interest was recorded annually. On December

Q55: The financial leverage ratio is a measure

Q56: The times interest earned ratio measures the

Q57: An amount is to be deposited in

Q58: How much would Kristen have to deposit

Q59: Most notes are not interest bearing.