Multiple Choice

On September 1, Linwell Corp. borrowed $70,000 from the Highland Bank for five months at 9%. Interest is due at maturity. The company's year-end is December 31, at which time any outstanding interest was accrued. The entry to record payment of the note and accrued interest on February 1, the due date, is:

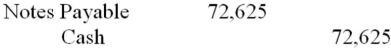

A)

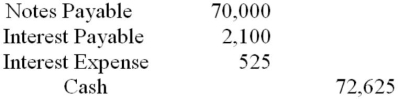

B)

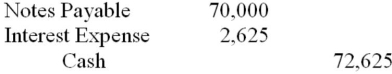

C)

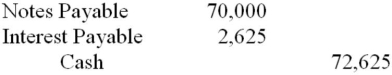

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q56: If a company intends to refinance a

Q57: Which of the following is correct with

Q58: Match the liabilities with their usual classification

Q59: The current portion of long-term debt should

Q60: G Co and A Co are both

Q62: Which of the following method of ordering

Q63: A cash register tape shows cash sales

Q65: In 2013, Toys 4 U reported inventory

Q66: The amount of sales tax collected by

Q125: A note payable must always be paid