Essay

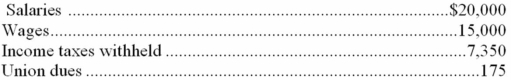

The following data were provided by the detailed payroll records of Journey Corporation for the month of March 20A:

Income taxes at an average 7.65% rate (no employee has reached the maximum) Required:

Income taxes at an average 7.65% rate (no employee has reached the maximum) Required:

1. Give the March 31, 20A entry to record the payroll and related employee deductions

2. Give the March 31, 20A entry to record the employer's payroll income tax expense

Correct Answer:

Verified

Requiremen...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q59: Most notes are not interest bearing.

Q67: Jake Company is involved in a lawsuit.

Q69: Current liabilities are short-term obligations that will

Q70: How should the amount of federal income

Q70: The amount of salary expense that a

Q74: A customer paid a total of $84,000

Q75: Alamo Autoworks, Inc. is involved in a

Q76: A contingent liability that has a remote

Q77: Future income tax obligations should be reported

Q96: Interest expense on a note payable is