Multiple Choice

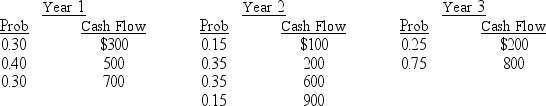

A project with a 3-year life has the following probability distributions for possible end of year cash flows in each of the next three years:  Using an interest rate of 8 percent, find the expected present value of these uncertain cash flows.(Hint: Find the expected cash flow in each year, then evaluate those cash flows.)

Using an interest rate of 8 percent, find the expected present value of these uncertain cash flows.(Hint: Find the expected cash flow in each year, then evaluate those cash flows.)

A) $1,204.95

B) $835.42

C) $1,519.21

D) $1,580.00

E) $1,347.61

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Of all the techniques used in finance,

Q31: Why is the present value of an

Q33: You are given the following cash flows.What

Q35: All else equal, if you expect to

Q36: A perpetuity is an annuity with perpetual

Q37: The difference between an ordinary annuity and

Q38: The effective annual rate is less than

Q39: Susan just signed a long-term lease on

Q67: The Desai Company just borrowed $1,000,000 for

Q88: You are currently at time period 0,and