Multiple Choice

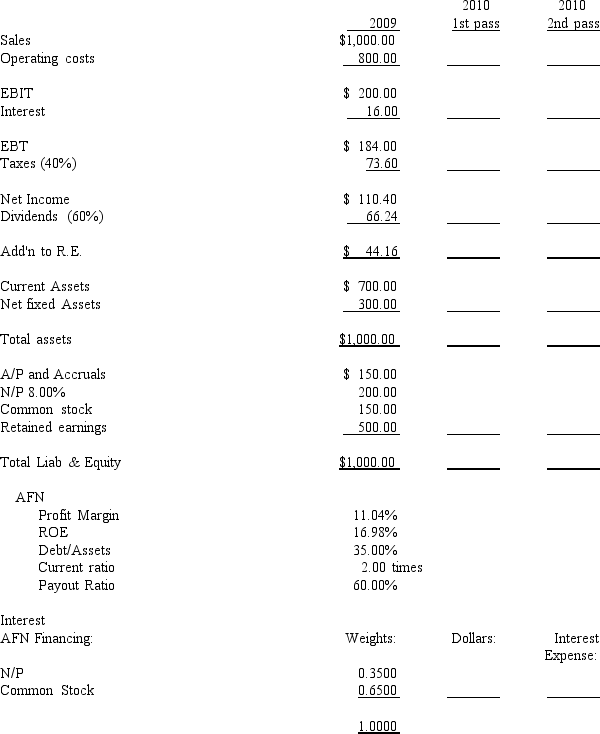

Information on the Crum Company:

-Refer to Crum Company.Crum expects sales to grow by 50% in 2010, and operating costs should increase at the same rate.Fixed assets were being operated at 40% of capacity in 2009, but all other assets were used to full capacity.Underutilized fixed assets cannot be sold.Current assets and spontaneous liabilities should increase at the same rate as sales during 2010.The company plans to finance any external funds needed as 35% notes payable and 65% common stock.After taking financing feedbacks into account, and after the second pass, what is Crum's projected ROE using the projected balance sheet method?

A) 16.98%

B) 23.73%

C) 25.68%

D) 19.61%

E) 23.24%

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The projected balance sheet method assumes that

Q12: <br>You have just taken out a loan

Q31: Which one of the following aspects of

Q75: Which of the following statements is correct?<br>A)

Q130: Which of the following liabilities is most

Q131: Assume a firm takes out a discounted

Q132: Which of the following is not one

Q133: The factor (lender) purchasing accounts receivable from

Q136: Today, computer simulation models can calculate multiple

Q139: A firm has the following balance