Essay

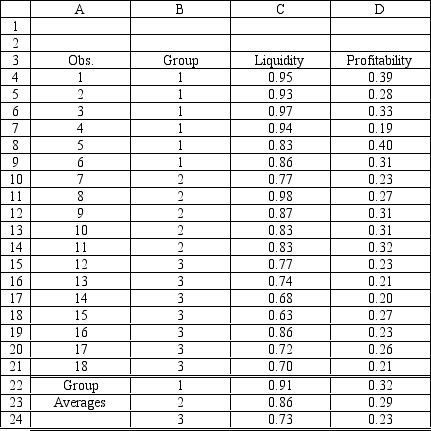

Exhibit 10.7

The information below is used for the following questions.

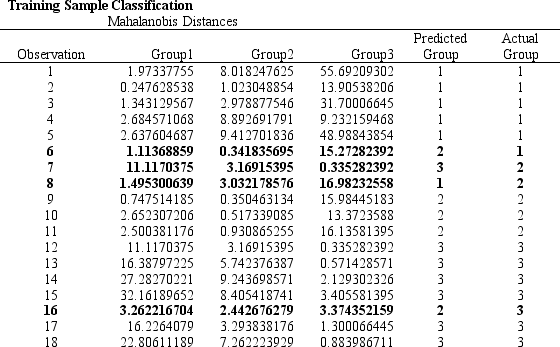

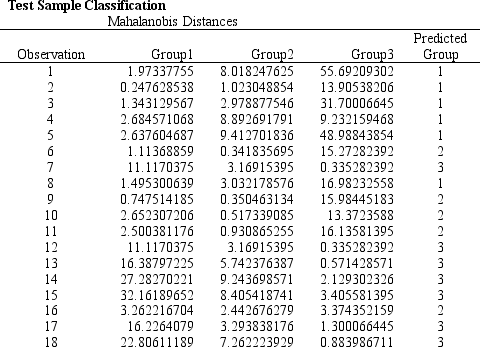

An investor wants to classify companies as being a High Risk Investment, Group 1, a Medium Risk Investment, Group 2, or a Low Risk Investment, Group 3. He has gathered Liquidity, Profitability data on 18 companies he has invested in and produced the following spreadsheet. The following Discriminant Analysis output using Risk Solver Platform (RSP) has also been generated.

-Refer to Exhibit 10.7. Based on the 18 observations in the model complete the following confusion/classification matrix.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: The term serves which of the

Q22: Exhibit 10.1<br>The following questions are based on

Q25: Exhibit 10.1<br>The following questions are based on

Q31: In a two-group discriminant analysis problem using

Q39: <br>A manager wants to classify people

Q39: Exhibit 10.1<br>The following questions are based on

Q47: Exhibit 10.1<br>The following questions are based on

Q51: In discriminant analysis the averages for the

Q61: Discriminant analysis (DA) differs from most other

Q123: If using the regression tool for two-group