Multiple Choice

Exhibit 14.6

The following questions use the information below.

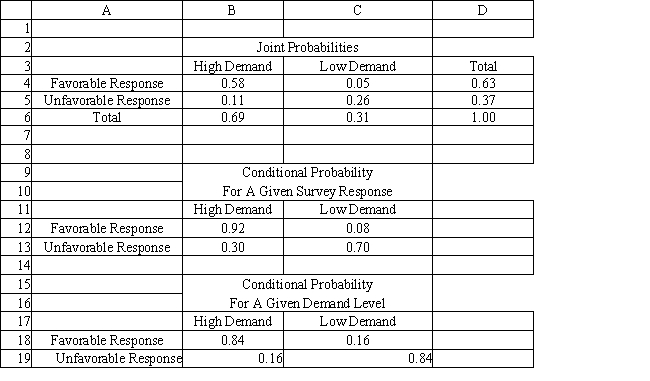

A company is planning a plant expansion. They can build a large or small plant. The payoffs for the plant depend on the level of consumer demand for the company's products. The company believes that there is an 69% chance that demand for their products will be high and a 31% chance that it will be low. The company can pay a market research firm to survey consumer attitudes towards the company's products. There is a 63% chance that the customers will like the products and a 37% chance that they won't. The payoff matrix and costs of the two plants are listed below. The company believes that if the survey is favorable there is a 92% chance that demand will be high for the products. If the survey is unfavorable there is only a 30% chance that the demand will be high. The following decision tree has been built for this problem. The company has computed that the expected monetary value of the best decision without sample information is 154.35 million. The company has developed the following conditional probability table for their decision problem.

-Which of the following summarizes the final outcome for each decision alternative?

A) payoff matrix

B) outcome matrix

C) yield matrix

D) performance matrix

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Exhibit 14.9<br>The following questions are based on

Q36: Exhibit 14.2<br>The following questions are based on

Q37: Exhibit 14.5<br>The following questions are based on

Q38: Under maximin rule a decision maker hedges

Q39: Exhibit 14.12<br>The following questions use the information

Q41: Exhibit 14.1<br>The following questions are based on

Q42: Exhibit 14.7<br>The following questions use the information

Q43: Exhibit 14.10<br>The following questions are based on

Q44: An analyst can apply a process known

Q45: Exhibit 14.4<br>The following questions are based on