Multiple Choice

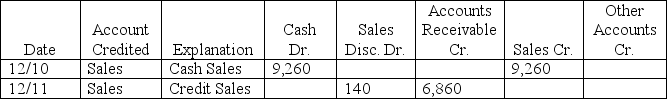

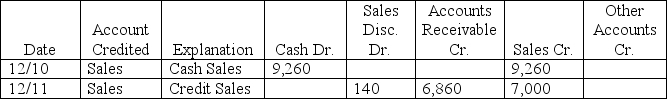

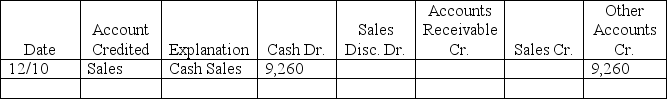

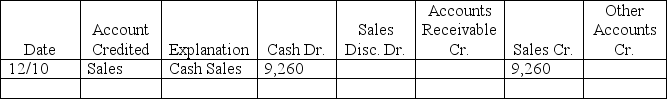

Argyle Company uses a cash receipts journal (periodic system) as shown below: How would the following transactions be recorded in this cash receipt journal?

-12/10 Sold merchandise to Sock Company for $9,260 cash (cost is $5,556)

- 12/11 Sold merchandise on credit to Gardner, Inc, invoice no. 873, for $7,000 (cost is $4,200) . Terms are 2/10, n/30.

A)

B)

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q13: The _ principle requires that an accounting

Q46: A procedure called direct posting of sales

Q66: _ processing accumulates source documents for a

Q73: The use of an Accounts Payable controlling

Q105: What are the five basic components of

Q106: A subsidiary ledger:<br>A)Includes transactions not covered by

Q113: The segment return on assets:<br>A)Can only be

Q145: Match the following terms with the appropriate

Q157: List the five basic principles of accounting

Q160: What is the segment return on assets