Multiple Choice

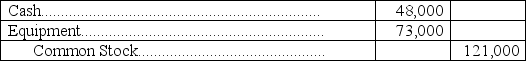

S. Reising contributed $48,000 in cash plus equipment valued at $73,000 to the Reising Construction Partnership. The journal entry to record the transaction for the partnership is:

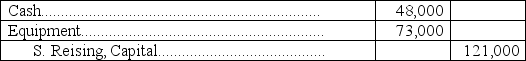

A)

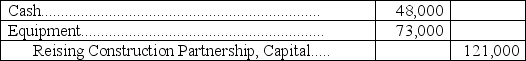

B)

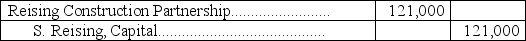

C)

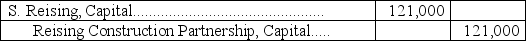

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q4: Tanner,Schmidt,and Hayes are partners with capital account

Q5: Mutual agency means each partner can commit

Q34: A capital deficiency exists when all partners

Q38: Groh and Jackson are partners.Groh's capital balance

Q63: A partnership designed to protect innocent partners

Q70: If partners devote their time and services

Q86: A partnership that has at least two

Q111: The life of a partnership is _

Q134: Brown and Rubix are partners.Brown's capital balance

Q170: Discuss the options for the allocation of