Multiple Choice

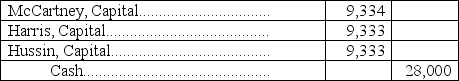

McCartney, Harris, and Hussin are dissolving their partnership. Their partnership agreement allocates income and losses equally among the partners. The current period's ending capital account balances are McCartney, $15,000, Harris, $15,000, Hussin, $(2,000) . After all the assets are sold and liabilities are paid, but before any contributions to cover any deficiencies, there is $28,000 in cash to be distributed. Hussin pays $2,000 to cover the deficiency in his account. The general journal entry to record the final distribution would be:

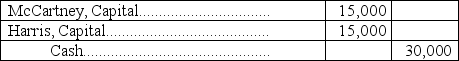

A)

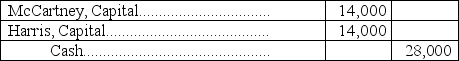

B)

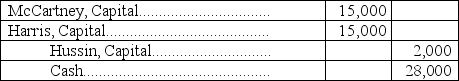

C)

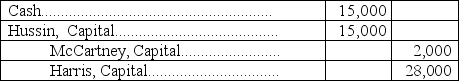

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Conley and Liu allow Lepley to purchase

Q47: Partnership accounting:<br>A) Is the same as accounting

Q54: Blaser,Lukins,and Franko formed a partnership with Blaser

Q54: Define the partner return on equity ratio

Q67: The statement of partners' equity shows the

Q84: When a partner leaves a partnership, the

Q89: Conley and Liu allow Lepley to purchase

Q114: A partnership recorded the following journal entry:

Q115: Which of the following best lists the

Q130: The BlueFin Partnership agreed to dissolve.The remaining