Multiple Choice

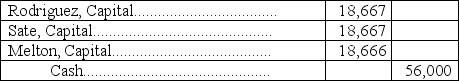

Rodriguez, Sate, and Melton are dissolving their partnership. Their partnership agreement allocates income and losses equally among the partners. The current period's ending capital account balances are Rodriguez, $30,000; Sate, $30,000; and Melton, $(4,000) . After all the assets are sold and liabilities are paid, but before any contributions are considered to cover any deficiencies, there is $56,000 in cash to be distributed. Melton pays $4,000 to cover the deficiency in her account. The general journal entry to record the final distribution would be:

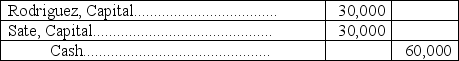

A)

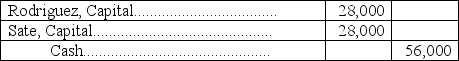

B)

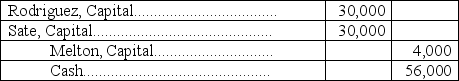

C)

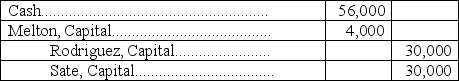

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Tanner,Schmidt,and Hayes are partners with capital account

Q25: Chen and Wright are forming a partnership.

Q42: Armstrong withdraws from the FAP Partnership. The

Q64: What are the ways that a new

Q73: What are the ways a partner can

Q76: Match the following definitions to their terms

Q85: Sierra and Jenson formed a partnership. Sierra

Q104: Khalid,Dina,and James are partners with beginning-year capital

Q108: The withdrawals account of each partner is

Q126: The equity section of the balance sheet