Multiple Choice

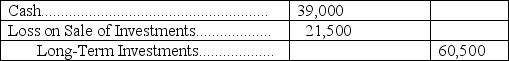

On January 4, 2011, Larsen Company purchased 5,000 shares of Warner Company for $59,500 plus a broker's fee of $1,000. Warner Company has a total of 25,000 shares of common stock outstanding and it is presumed the Larsen Company will have a significant influence over Warner. During each of the next two years, Warner declared and paid cash dividends of $0.85 per share. Its net income was $72,000 and $67,000 for 2011 and 2012, respectively. The January 12, 2013, entry to record the sale of 3,000 shares of Warner Company stock for $39,000 cash should be:

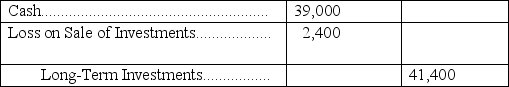

A)

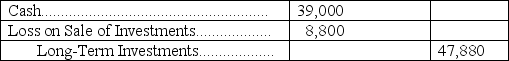

B)

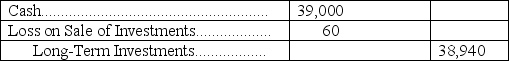

C)

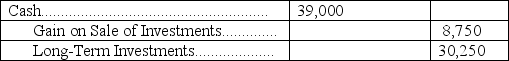

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q31: A company reported net income of $100,000

Q45: Long-term investments are usually held as an

Q46: What is comprehensive income and how is

Q47: A company paid $37,800 plus a broker's

Q64: Foreign exchange rates fluctuate due to changing

Q65: Brown Company sold supplies in the amount

Q68: Trading securities are securities that are purchased

Q93: Trading securities,held-to-maturity debt securities,and equity securities giving

Q123: A company had net income of $76,000

Q164: Texana Inc. imports inventory from Mexico. Prepare