Essay

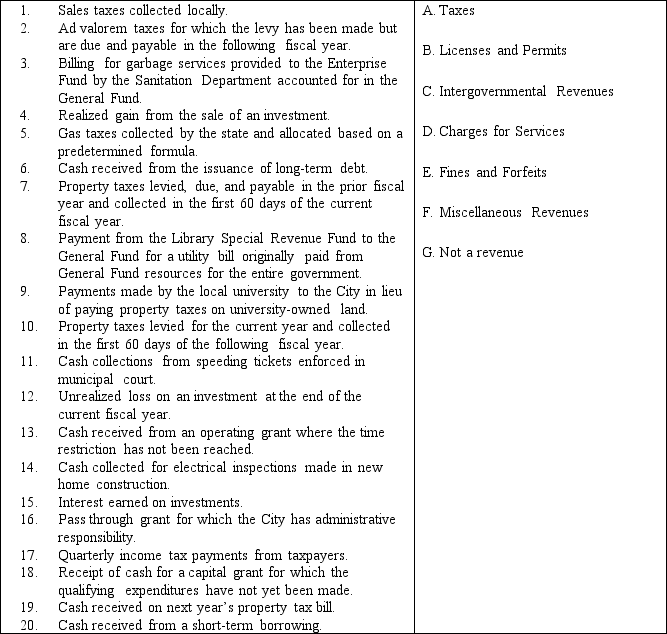

SEQ CHAPTER \h \r 1Listed below in the left column are some events that may or may not be revenues for the General Fund. Listed in the right column are the classifications of revenues for governmental funds. Correctly match each event with the appropriate revenue classification. Unless specifically stated otherwise, assume all amounts are earned, measurable, and available. If the event is not a revenue, state how the event would be reported in the current year General Fund financial statements.

Correct Answer:

Verified

1. A

2. G - Deferred Revenue

3. D

4. F

5...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2. G - Deferred Revenue

3. D

4. F

5...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Property taxes are an example of which

Q12: When a tax lien is formalized, a

Q19: The Town of Lily Branch anticipated that

Q20: Assume that a general capital asset was

Q21: Which of the following statements regarding the

Q24: Under the modified accrual basis, revenues are

Q27: The Jackson Independent School District began the

Q28: The City of Jonesboro allows discounts

Q29: A government has a fiscal year end

Q31: The county received $75,000 from the annual