Essay

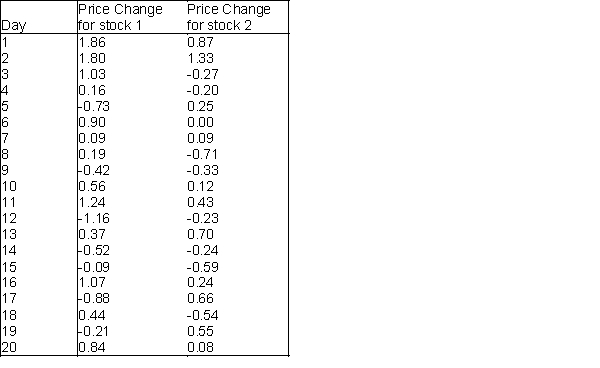

An investor wants to compare the risks associated with two different stocks. One way to measure the risk of a given stock is to measure the variation in the stock's daily price changes. The investor obtains a random sample of 20 daily price changes for stock 1 and 20 daily price changes for stock 2. These data are shown in the table below. Show how this investor can compare the risks associated with the two stocks by testing the null hypothesis that the variances of the stocks are equal. Use  = 0.10 and interpret the results of the statistical test.

= 0.10 and interpret the results of the statistical test.

Correct Answer:

Verified

vs.

vs.  Test statistic: F-value=

Test statistic: F-value=  and p...

and p...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Side-by-side box plots are typically a good

Q35: A null hypothesis is a statement about

Q46: The p-value of a sample is the

Q48: An automobile manufacturer needs to buy aluminum

Q50: The power of a test is the

Q51: The chi-square test for normality makes a

Q52: The = sign belongs in the null

Q53: (A) Assume that the national average weekly

Q55: Q-Mart is interested in comparing customers who

Q56: The null and alternative hypotheses divide all