Short Answer

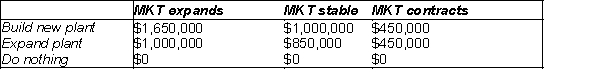

The Waco Tire Company (WTC) is considering expanding production to meet possible increases in demand. WTC's alternatives are to construct a new plant, expand the existing plant, or do nothing in the short run. It will cost them $1 million to build a new facility and $600,000 to expand their existing facility. The market for this particular product may expand, remain stable, or contract. ETC's marketing department estimates the probabilities of these market outcomes as 0.30, 0.45, and 0.25, respectively. The expected revenue for each alternative is presented in the table below.

-(A) What is WTC's payoff if they build a new plant and the market expands?

(B) What is WTC's payoff if they build a new plant and the market is stable?

(C) What is WTC's payoff if they build a new plant and the market contracts?

(D) What is WTC's payoff if they expand the plant and the market expands?

(E) What is WTC's payoff if they expand the plant and the market is stable?

(F) What is WTC's payoff if they expand the plant and the market contracts?

(G) What is WTC's payoff if they do nothing and the market expands?

(H) What is WTC's payoff if they do nothing and the market is stable?

(I) What is WTC's payoff if they do nothing and the market contracts?

Correct Answer:

Verified

(A) $650,000

(B) $0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(B) $0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: A strategy region chart is useful for

Q6: Exponential utility has an adjustable parameter called

Q8: The owner of a radio station in

Q12: In the nomenclature of Bayes' Rule, which

Q13: If x is a monetary value (a

Q14: The owner of a radio station in

Q15: In decision trees, time:<br>A) is constant<br>B) proceeds

Q62: The network can conduct market research to

Q63: Rational decision makers are never willing to

Q74: Construct a decision tree to identify the