Essay

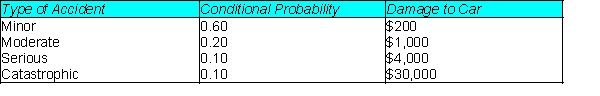

Ms. Rich has just bought a new $30,000 car. As a reasonably safe driver, she believes that there is only a 5% chance of being in an accident in the forthcoming year. If she is involved in an accident, the damage to her new car depends on the severity of the accident. The probability distribution for the range of possible accidents and the corresponding damage amounts (in dollars) are shown in the table below. Ms. Rich is trying to decide whether she is willing to pay $170 each year for collision insurance with a $300 deductible. Note that with this type of insurance, she pays the first $300 in damages if she causes an accident, and the insurance company pays the remainder.

Distribution of Accident Types and Corresponding Damage Amounts

-Determine the payoffs associated with each possible decision and type of accident (cost in dollars).

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Bayes' rule can be used for updating

Q23: The solution procedure that was introduced in

Q24: Why is there a kink in the

Q25: Ms. Rich has just bought a new

Q26: Southport Mining Corporation is considering a new

Q29: The following is a payoff table giving

Q30: A risk profile from PrecisionTree lists:<br>A) the

Q31: Using a strategy region graph, determine what

Q45: Should the credit union purchase the report

Q76: Generate a risk profile for each of