Essay

Southport Mining Corporation is considering a new mining venture in Indonesia. There are two uncertainties associated with this prospect; the metallurgical properties of the ore and the net price (market price minus mining and transportation costs) of the ore in the future.

The metallurgical properties of the ore would be classified as either "high grade" or "low grade". Southport's geologists have estimated that there is a 70% chance that the ore will be "high grade", and otherwise, it will be "low grade". Depending on the net price, both ore classifications could be commercially successful.

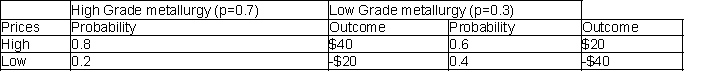

The anticipated net prices depended on market conditions, and also on the metallurgical properties of the ore. Southport's economists have simplified the continuous distribution of possible prices into a two-outcome discrete distribution ("high" or "low" net price) for the investment analysis. The probabilities of these net prices, and the associated outcomes (in millions of dollars), are summarized below.

-What should the Southport do? What is their expected profit?

Correct Answer:

Verified

The tree above shows that the ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: The expected value of sample information (EVSI)is

Q25: Suppose that Southport could consider another alternative

Q28: Should the network purchase the report if

Q37: The owner of a radio station in

Q38: What course of action is optimal for

Q43: What is the probability that a randomly

Q44: In decision trees, probabilities are listed on

Q49: In making decisions,we choose the decision with

Q59: EMV criteria guarantee good outcomes.

Q68: The expected value of perfect information (EVPI)is