Essay

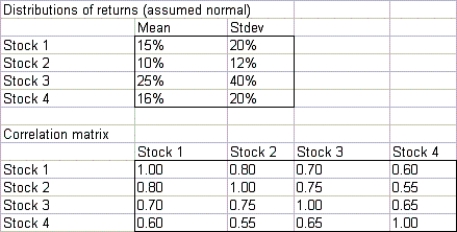

Suppose you have invested 25% of your portfolio in four different stocks. The mean and standard deviation of the annual return on each stock are as shown below. The correlations between the annual returns on the four stocks are also shown below.

-What is the probability that your portfolio will lose money during the course of a year?

Correct Answer:

Verified

There is a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: In bidding models,the simulation input variable is

Q38: Simulate Amanda's portfolio over the next 30

Q39: Bidding for contracts is an example of

Q41: Financial analysts often investigate the value at

Q42: (A) Estimate the mean and median value

Q44: What is the appropriate distribution for the

Q45: Consider a customer whose first car is

Q47: Simulate Amanda's portfolio over the next 30

Q48: Suppose that Coke<sup>®</sup> and Pepsi<sup>®</sup> are in

Q56: In marketing and sales models,the primary source