Essay

(A) Use a simulation model to help the institute decide how many violins they must reserve with the instrument company. Consider five different possible reservation quantities: 400, 500, 600, 700, 800. Which of these quantities yields the highest total revenue, net of instrument costs?

(B) Which simulation yields the largest median total revenue?

(C) Which simulation has the most risk as measured by spread or dispersion in the data? Please state clearly what statistic you used to answer this question.

(D) Are there any simulations in which there is at least a 1 in 20 (i.e., 5%) chance of getting a negative total revenue? Briefly explain in one sentence.

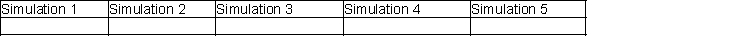

(E) For each simulation, what is the probability of exceeding $175,000 in total revenue (approximate these numbers as closely as possible from the data given in the above table). Please put your answer in the following table:  (F) Considering your answers for (A) through (E), please state how many instruments you think should be reserved in advance and explain why.

(F) Considering your answers for (A) through (E), please state how many instruments you think should be reserved in advance and explain why.

(G) Suppose the institute is able to negotiate with the instrument company to reduce the cost for a violin from $500 to $350. Re-run the simulation model using the same reservation quantities (but with $350 for the unused instrument cost). Has the reservation quantity that yields the highest average revenue changed? If so, please explain why this has occurred.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: In general, important characteristics of probability distributions

Q3: A continuous probability distribution is characterized by

Q4: Oregon State University has reached the final

Q5: A probability distribution is continuous if its

Q8: If we want to model the time

Q8: We can think of the uniform distribution

Q9: The RAND() function in Excel<sup>®</sup> models which

Q20: Which of the following statements are true?<br>A)The

Q34: A correlation matrix must always be symmetric,so

Q56: The three parameters required to specify a