Essay

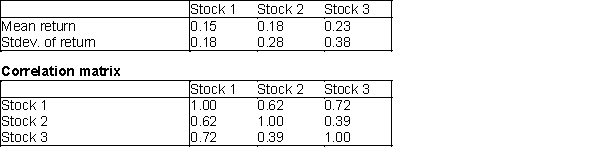

Assume that you are given the following means, standard deviations, and correlations for the annual return on three stocks.  The correlation between stocks 1 and 2 is 0.62, between stocks 1 and 3 is 0.72, and between stocks 2 and 3 is 0.39. You have $12,000 to invest and can invest no more than 55% of your money in any single stock. Determine the minimum variance portfolio that yields an expected annual return of at least 0.15

The correlation between stocks 1 and 2 is 0.62, between stocks 1 and 3 is 0.72, and between stocks 2 and 3 is 0.39. You have $12,000 to invest and can invest no more than 55% of your money in any single stock. Determine the minimum variance portfolio that yields an expected annual return of at least 0.15

Correct Answer:

Verified

Correct Answer:

Verified

Q5: In a typical minimum cost network flow

Q7: If all the supplies and demands for

Q21: For some types of integer programming problems,their

Q28: A global optimal solution is not necessarily

Q28: At time 0, you have $10,000. Investments

Q29: A pharmaceutical company produces a drug from

Q35: A post office requires different numbers of

Q45: Transportation costs for a given route are

Q52: In an optimized network flow model (MCNFM),all

Q83: A manufacturer can sell product 1 at