Essay

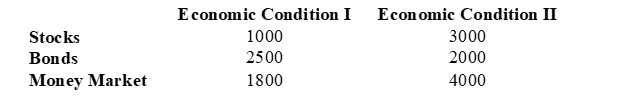

Assume you have a sum of money available that you would like to invest in one of the three available investment plans: stocks, bonds, or money market. The conditional payoffs of each plan under two possible economic conditions are shown below. The probability of the occurrence of economic condition I is 0.28.

a.Compute the expected value of the three investment options. Which investment option would you select, based on the expected values?

b.Compute the expected value with perfect information (i.e., expected value under certainty).

c.Compute the expected value of perfect information (EVPI).

Correct Answer:

Verified

a.EV(Stocks) = 2440; EV(Bonds)...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Nodes indicating points where an uncertain event

Q11: The probability of both sample information and

Q12: Assume you are faced with the following

Q13: The probabilities of states of nature after

Q14: Exhibit 21-5<br>Below you are given a payoff

Q16: For a decision alternative, the weighted average

Q17: Exhibit 21-1<br>Below you are given a payoff

Q18: A tabular representation of the payoffs for

Q19: An automobile manufacturer must make an immediate

Q20: The process of revising prior probabilities to