Short Answer

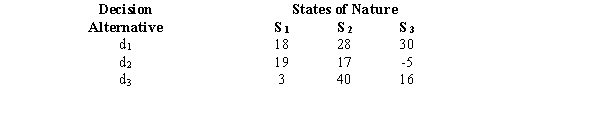

Suppose we are interested in investing in one of three investment opportunities: d1, d2, or d3. The following profit payoff table shows the profits (in thousands of dollars) under each of the 3 possible economic conditions-S1, S2, and S3. The probability of the occurrence of S1 is 0.1, and the probability of the occurrence of S2 is 0.3.

a.Determine the expected value of each alternative and indicate which decision alternative is the best.

b.Determine the expected value with perfect information about the states of nature.

c.Determine the expected value of perfect information.

Correct Answer:

Verified

a.28.2, 4,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q51: The following payoff table shows profits for

Q52: Exhibit 21-4<br>Below you are given a payoff

Q53: An investor has a choice between four

Q54: Future events that cannot be controlled by

Q55: A graphic presentation of the expected gain

Q57: Assume you are faced with the following

Q58: Nodes indicating points where a decision is

Q59: Below you are given a payoff table

Q60: A decision criterion which weights the payoff

Q61: Prior probabilities are the probabilities of the