Essay

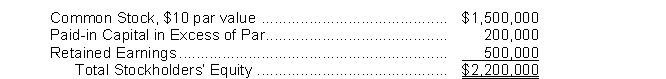

Yates Corporation has the following stockholders' equity accounts on January 1, 2018:  The company uses the cost method to account for treasury stock transactions. During 2018, the following treasury stock transactions occurred:

The company uses the cost method to account for treasury stock transactions. During 2018, the following treasury stock transactions occurred:

April 1 Purchased 10,000 shares at $19 per share.

August 1 Sold 4,000 shares at $22 per share.

October 1 Sold 2,000 shares at $15 per share.

Instructions

(a) Journalize the treasury stock transactions for 2018.

(b) Prepare the Stockholders' Equity section of the balance sheet for Yates Corporation at December 31, 2018. Assume net income was $110,000 for 2018.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: As soon as a corporation is authorized

Q29: New Corp. issues 2,000 shares of $10

Q35: Preferred stockholders have a priority over common

Q38: Wise Company had the following transactions.<br>1. Issued

Q53: The return on common stockholders' equity is

Q53: A corporation's own stock that has been

Q104: A company would not acquire treasury stock<br>A)

Q113: If stock is issued in exchange for

Q167: Restricting retained earnings for the cost of

Q185: Additional paid-in capital includes all of the