Essay

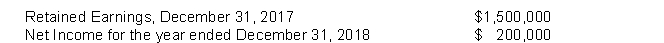

The following information is available for Zip Corporation:  The company accountant, in preparing financial statements for the year ending December 31, 2018, has discovered the following information:

The company accountant, in preparing financial statements for the year ending December 31, 2018, has discovered the following information:

The company's previous bookkeeper, who has been fired, had recorded depreciation expense on equipment in 2016 and 2017 using the double-declining-balance method of depreciation. The bookkeeper neglected to use the straight-line method of depreciation which is the company's policy. The cumulative effects of the error on prior years was $35,000, ignoring income taxes. Depreciation was computed by the straight-line method in 2018.

Instructions

(a) Prepare the entry for the prior period adjustment.

(b) Prepare the retained earnings statement for 2018.

Correct Answer:

Verified

Correct Answer:

Verified

Q43: When the selling price of treasury stock

Q72: The following information is available for Matlin

Q73: Cooke Corporation issues 10,000 shares of $50

Q74: Last Inc., has 2,000 shares of 6%,

Q76: During 2018, Pink Corporation had the following

Q79: On January 1, 2018, Dreamy Company issued

Q81: Darman Company issued 700 shares of no-par

Q140: The purchase of treasury stock<br>A) decreases common

Q168: Preferred stockholders generally do not have the

Q202: Treasury stock should not be classified as