Essay

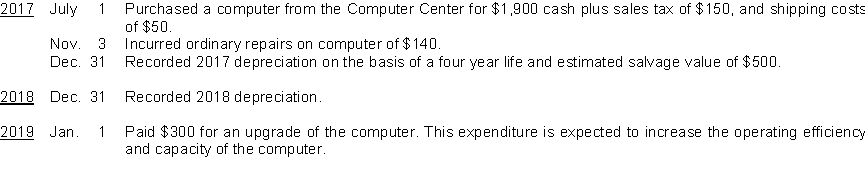

Foley Word Processing Service uses the straight-line method of depreciation. The company's fiscal year end is December 31. The following transactions and events occurred during the first three years.  Instructions

Instructions

Prepare the necessary entries. (Show computations.)

Correct Answer:

Verified

Correct Answer:

Verified

Q5: A plant asset cost $90,000 when it

Q7: Karley Company sold equipment on July 1,

Q10: A gain or loss on disposal of

Q14: Fleming Company purchased a machine on January

Q15: The declining-balance method is an accelerated method

Q104: Natural resources are<br>A) depreciated using the units-of-activity

Q118: In the case of an exchange of

Q124: The method most commonly used to compute

Q224: Gagner Clinic purchases land for $175000 cash.

Q277: Identify the following expenditures as capital expenditures