Essay

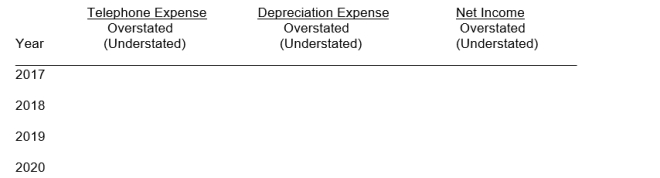

On January 1, 2016 Grier Company purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On January 1, 2017 more telephone equipment was purchased to tie-in with the current system for $10,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Telephone Expense. Grier Company uses the straight-line method of depreciation.

Instructions

Prepare a schedule showing the effects of the error on Telephone Expense, Depreciation Expense, and Net Income for each year and in total beginning in 2017 through the useful life of the new equipment.

Correct Answer:

Verified

Correct Answer:

Verified

Q56: Dougan Company purchased equipment on January 1,

Q64: A plant asset acquired on October 1,

Q67: Once an asset is fully depreciated no

Q94: In computing depreciation salvage value is<br>A) the

Q185: A loss on disposal of a plant

Q198: Ermler Company purchased a machine at a

Q233: The depreciable cost of a plant asset

Q239: Equipment with a cost of $400000 has

Q271: A truck costing $110000 was destroyed when

Q292: Conceptually the cost allocation procedures for natural