Essay

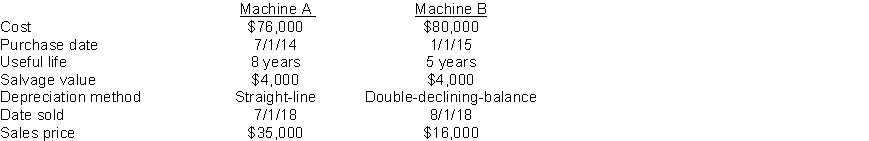

Zimmer Company sold the following two machines in 2018:  Instructions

Instructions

Journalize all entries required to update depreciation and record the sales of the two assets in 2018. The company has recorded depreciation on the machines through December 31, 2017.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: With the exception of land plant assets

Q23: The cost of paving fencing and lighting

Q26: A change in the estimated salvage value

Q33: Depreciation is a process of<br>A) asset devaluation.<br>B)

Q167: Which of the following methods of computing

Q190: A company purchased land for $90000 cash.

Q258: The cost of a patent should be

Q269: Gorman Mining invested $960,000 in a mine

Q272: The depreciation method that applies a constant

Q302: The entry to record patent amortization usually