Essay

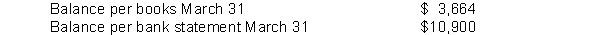

Bell Food Store developed the following information in recording its bank statement for the month of March.  -------------------------------------------

-------------------------------------------

(1) Checks written in March but still outstanding $7,000.

(2) Checks written in February but still outstanding $3,100.

(3) Deposits of March 30 and 31 not yet recorded by bank $5,200.

(4) NSF check of customer returned by bank $1,200.

(5) Check No. 210 for $593 was correctly issued and paid by bank but incorrectly entered in the cash payments journal as payment on account for $539.

(6) Bank service charge for March was $50.

(7) A payment on account was incorrectly entered in the cash payments journal and posted to the accounts payable subsidiary ledger for $824 when Check No. 318 was correctly prepared for $284. The check cleared the bank in March.

(8) The bank collected a note receivable for the company for $3,000 plus $100 interest revenue.

Instructions

Prepare a bank reconciliation at March 31.

Correct Answer:

Verified

Correct Answer:

Verified

Q116: The cash balance per books for Feagen

Q117: A $100 petty cash fund has cash

Q118: Medaid is a medical office management franchise.

Q119: An example of poor internal control is<br>A)

Q120: Unicycle Company developed the following reconciling

Q122: Prepare the entry to replenish the $200

Q123: Joe Foss has worked for Dr. Sam

Q180: Checks received through the mail should<br>A) immediately

Q181: When opening a bank checking account a

Q191: The duties of approving an item for