Multiple Choice

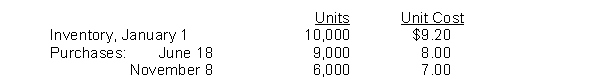

Eneri Company's inventory records show the following data:  A physical inventory on December 31 shows 4,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. If the company uses FIFO, what is the gross profit for the period?

A physical inventory on December 31 shows 4,000 units on hand. Eneri sells the units for $13 each. The company has an effective tax rate of 20%. Eneri uses the periodic inventory method. If the company uses FIFO, what is the gross profit for the period?

A) $95,000

B) $99,266

C) $99,960

D) $103,800

Correct Answer:

Verified

Correct Answer:

Verified

Q64: An error that overstates the ending inventory

Q99: Overstating ending inventory will overstate all of

Q101: A company just starting business made the

Q102: Inventory is reported in the financial statements

Q103: Pappy's Staff Junkets has the following inventory

Q105: Clooney Department Store estimates inventory by using

Q106: As a result of a thorough physical

Q108: The accountant at Cedric Company has determined

Q138: The first-in first-out (FIFO) inventory method results

Q209: Inventories affect<br>A) only the balance sheet.<br>B) only