Multiple Choice

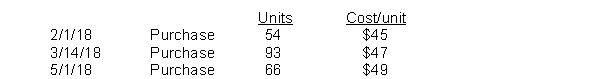

Romanoff Industries had the following inventory transactions occur during 2018:  The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using LIFO? (rounded to whole dollars)

The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using LIFO? (rounded to whole dollars)

A) $2,323

B) $2,486

C) $3,318

D) $3,552

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Companies adopt different cost flow methods for

Q59: Inventory items on an assembly line in

Q86: Which of the following statements is correct

Q130: Netta Shutters has the following inventory information.

Q132: Washington Bottom Company reports the following for

Q133: H. Hunter Company's records indicate the following

Q134: Partridge Bookstore had 500 units on hand

Q136: Under GAAP, companies can choose which inventory

Q141: For companies that use a perpetual inventory

Q167: Disclosures about inventory should include each of