Multiple Choice

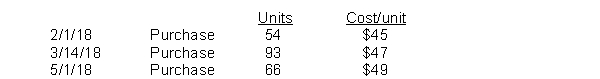

Romanoff Industries had the following inventory transactions occur during 2018:  The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

The company sold 150 units at $70 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, what is the company's after-tax income using FIFO? (rounded to whole dollars)

A) $2,322

B) $2,486

C) $3,318

D) $3,552

Correct Answer:

Verified

Correct Answer:

Verified

Q51: Priscilla has the following inventory information. <img

Q52: Turturro Department Store utilizes the retail inventory

Q53: Romanoff Industries had the following inventory transactions

Q54: Waters Hardware reported cost of the goods

Q55: Nolen Company is preparing the annual financial

Q58: <sup></sup>138. Pappy's Staff has the following inventory

Q59: The accountant at Almira Company is figuring

Q60: Inventory accounting under IFRS differs from GAAP

Q61: Eneri Company's inventory records show the following

Q101: Selection of an inventory costing method by