Essay

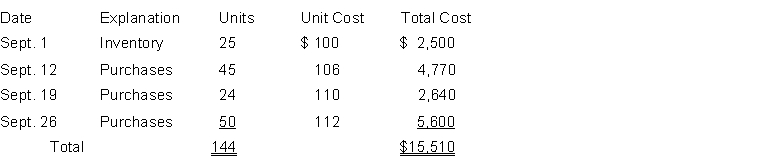

Stengel Company sells a snowboard, White-Out, that is popular with snowboard enthusiasts. Presented below is information relating to Stengel Company's purchases of White-Out snowboards during September. During the same month, 124 White-Out snowboards were sold at $160 each. Stengel Company uses a periodic inventory system.  Instructions

Instructions

(a) Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO method. Prove the amount allocated to cost of goods sold under each method.

(b) For both FIFO and LIFO, calculate the sum of inventory and cost of goods sold. What do you notice about the answer you found for each method?

(c) What is gross profit under each method?

(d) Which method results in a larger amount reported for assets on the balance sheet? Which results in a larger amount reported for stockholders' equity on the balance sheet?

Correct Answer:

Verified

(b)

(b)

FIFO $2240 (ending inventory) + 1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

FIFO $2240 (ending inventory) + 1...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Inventories are defined by IFRS as<br>A) held-for-sale

Q25: Match the items below by entering the

Q26: A company just starting in business purchased

Q33: Specific Identification must be used for inventory

Q79: The cost of goods available for sale

Q122: Under generally accepted accounting principles management has

Q171: The only acceptable cost flow assumptions under

Q173: The cost of goods available for sale

Q190: Days in inventory is calculated by dividing<br>A)

Q226: Cost of goods sold is computed from