Essay

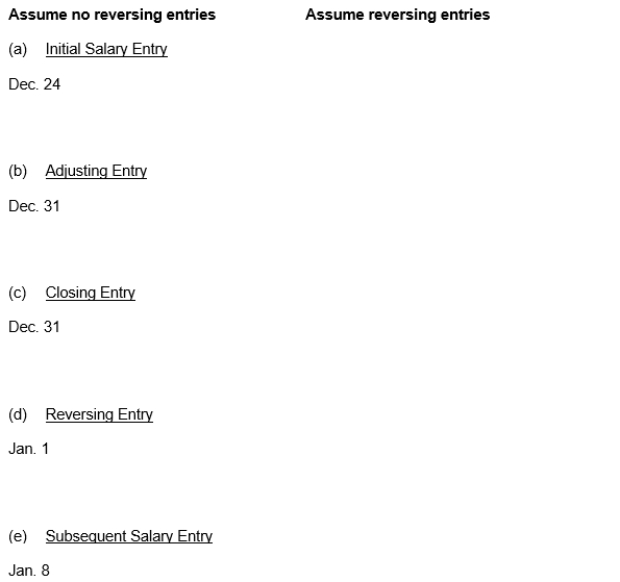

Transaction and adjustment data for Doty Company for the calendar year end is as follows:

1. December 24 (initial salary entry): $12,000 of salaries earned between December 1 and December 24 are paid.

2. December 31 (adjusting entry): Salaries earned between December 25 and December 31 are $3,000. These will be paid in the January 8 payroll.

3. January 8 (subsequent salary entry): Total salary payroll amounting to $8,000 was paid.

Instructions

Prepare two sets of journal entries as specified below. The first set of journal entries should assume that the company does not use reversing entries, and the second set should assume that reversing entries are utilized by the company.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Which of the following is an optional

Q57: Both IFRS and GAAP require disclosure about<br>A)

Q80: At the end of an accounting period

Q98: The first required step in the accounting

Q211: If the total debit column exceeds the

Q217: All revenue and expense accounts have been

Q218: Closing the dividends account to Retained Earnings

Q219: The dividends account is a permanent account

Q220: The adjusted trial balance for Molina Company

Q223: A double rule (double underline) applied to