Essay

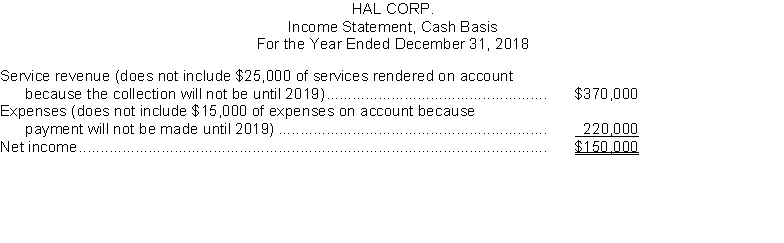

Hal Corp. prepared the following income statement using the cash basis of accounting:  Additional data:

Additional data:

1. Depreciation on a company automobile for the year amounted to $6,000. This amount is not included in the expenses above.

2. On January 1, 2018, paid for a two-year insurance policy on the automobile amounting to $1,800. This amount is included in the expenses above.

Instructions

(a) Recast the above income statement on the accrual basis in conformity with generally accepted accounting principles. Show computations and explain each change.

(b) Explain which basis (cash or accrual) provides a better measure of income.

Correct Answer:

Verified

Service revenue should include the $250...

Service revenue should include the $250...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: Adjusting entries are required<br>A) yearly.<br>B) quarterly.<br>C) monthly.<br>D)

Q4: Bakesale Enterprises purchased equipment on May 1,

Q9: Prepare adjusting entries for the following transactions.

Q13: The adjusted trial balance of Rocky Acre

Q62: Which of the following would not result

Q75: The book value of a depreciable asset

Q124: Management usually desires _ financial statements and

Q215: Which of the following is in accordance

Q233: Revaluation of land and buildings is permitted

Q248: The going concern assumption is that the