Essay

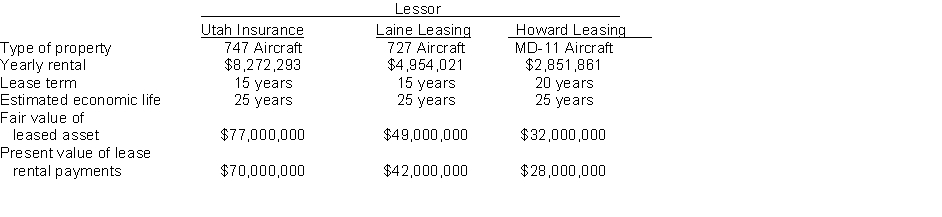

Presented below are three different aircraft lease transactions that occurred for Western Airways in 2017. All the leases start on January 1, 2017. In no case does Western receive title to the aircraft during or at the end of the lease period; nor is there a bargain purchase option.  Instructions

Instructions

(a) Which of the above leases are operating leases and which are finance leases? Explain your answer.

(b) How should the lease transaction with Utah Insurance be recorded in 2017?

(c) How should the lease transaction with Laine Leasing be recorded in 2017?

Correct Answer:

Verified

(a) The Utah Insurance lease is a financ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: A contingent liability should be recorded in

Q13: Roberts Company is preparing monthly adjusting entries

Q15: Which of the following is not a

Q16: Repair costs incurred in honoring warranty contracts

Q18: Which of the following statements concerning leases

Q22: If the present value of future lease

Q66: Contingent liabilities should be recorded in the

Q178: Warranty expenses are reported on the income

Q188: Post-retirement benefits consist of payments by employers

Q218: A contingency that is remote<br>A) should be