Essay

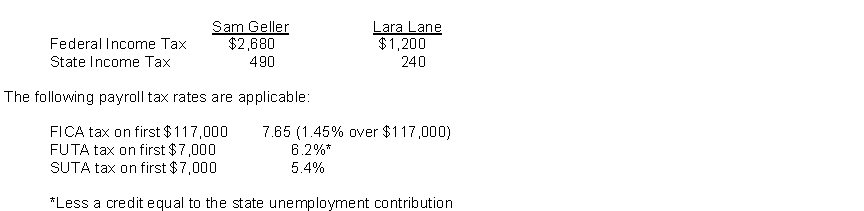

Sam Geller had earned (accumulated) salary of $110,000 through November 30. His December salary amounted to $9,800. Lara Lane began employment on December 1 and will be paid her first month's salary of $7,000 on December 31. Income tax withholding for December for each employee is as follows:  Instructions

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll. Round all calculations to the nearest dollar.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: FICA taxes and federal income taxes are

Q30: Assuming a FICA tax rate of 7.65%

Q34: Jerri Rice has worked 44 hours this

Q35: A good internal control feature is to

Q36: The form showing gross earnings, FICA taxes

Q38: Match the items below by entering the

Q39: Warren Company's payroll for the week ending

Q106: A payroll tax expense which is borne

Q137: By January 31 following the end of

Q196: The effective federal unemployment tax rate is